Send commercial loan broker fee agreement via email, link, or fax. You can also download it, export it or print it out.

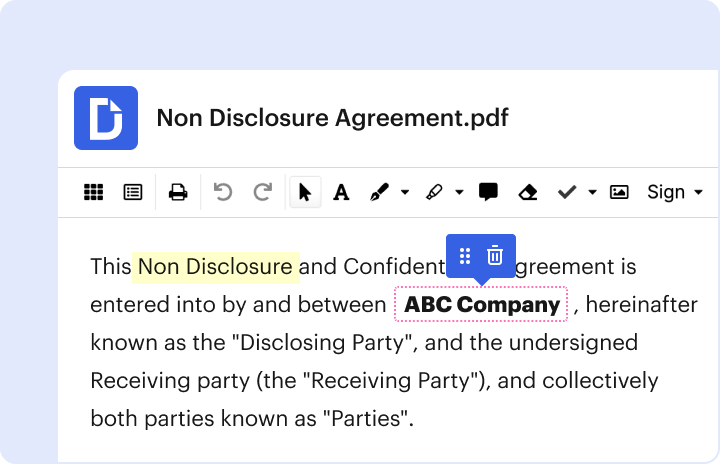

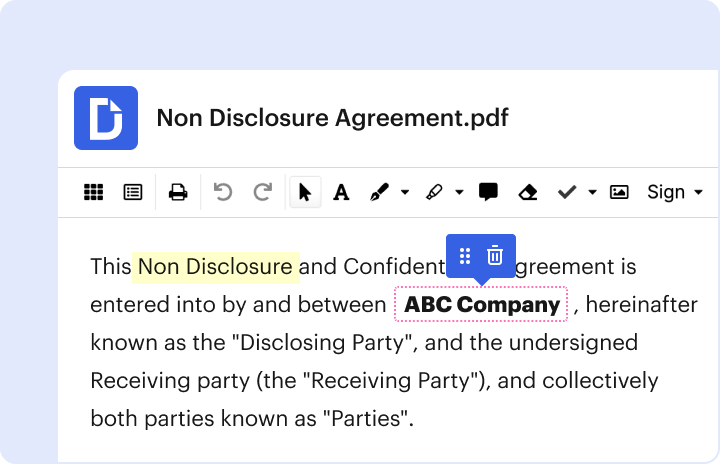

Adjusting paperwork with our extensive and intuitive PDF editor is simple. Make the steps below to complete Commercial loan broker agreement template online easily and quickly:

Benefit from DocHub, one of the most easy-to-use editors to rapidly handle your documentation online!

Fill out commercial loan broker agreement template onlineWe have answers to the most popular questions from our customers. If you can't find an answer to your question, please contact us.

What does a commercial loan broker do?Commercial loan brokers act as a matchmaker for lenders and businesses who have been denied a traditional loan. A loan broker is often the last resort for businesses in need of funding and the loan broker needs to be ready to provide that funding.

Can you make millions as a mortgage broker?So you see, it is possible to make a million dollars a year in the mortgage business AND have an amazing life outside of work! Gibran Nicholas is a speaker, trainer and coach to over 7,000 of America's top entrepreneurs and trusted advisors.

How much do commercial finance brokers charge?Although some lenders will expect some of the fee to be paid on offer, it is usually possible to add the fee to the loan. Broker fees \u2013 most brokers will charge broker fees for arranging. This is often upwards of 1% of the loan amount.

What does a commercial loan broker do?Commercial loan brokers act as a matchmaker for lenders and businesses who have been denied a traditional loan. A loan broker is often the last resort for businesses in need of funding and the loan broker needs to be ready to provide that funding.

How much does a commercial mortgage broker make on a deal?However, a typical range might be 0.5% to 1.2% of your full mortgage amount. The exact percentage will also depend on the term and type of the mortgage. For example, if your mortgage was $500,000 and your broker was paid a 1% commission, they would receive $5,000.

commercial broker fee agreement template commercial loan broker pdf commercial real estate broker agreement sample loan broker commission agreement loan consultant fee agreement broker commission agreement word mortgage broker fee agreement pdf sample agreement between broker and agent

What are Business Loan Brokers? Small business loan brokers make money by helping business owners obtain business cash flow loans, equipment loans, expansion loans, and other types of small business financing. They usually get a commission as a percentage of the loan amount paid by the lender.

Do you need a license for commercial lending in Florida?Do I need a license for commercial mortgages? Most commercial lending is exempt from Chapter 494; however, you should review Chapter 494 and seek legal counsel.

What does a commercial finance broker do?Commercial Finance Brokers. Commercial finance brokers act as a go-between service for businesses who are looking to raise finance and commercial lenders. They arrange the business loan from start to finish and usually charge a fee or are paid a commission by the lender - sometimes both.

How can I become a commercial mortgage broker?Employers expect either experience in the real estate or lending industry or a bachelor's degree in economics, finance, business, or a related field. A mortgage broker also needs a state license. You need to take a class and an exam administered by the National Mortgage Licensure System (NMLS) to obtain this license.

Do you need a license to be a commercial loan broker?Commercial lending does not come with the same restrictions as residential lending. In fact, you do not need a commercial license to become a commercial mortgage broker in many cases. Most states do not require commercial licensure, but 20 states require a license.

Contract for Sale of Commercial Real Estate. Table of Contents. Property Being Sold. . . 3. Purchase Price, Earnest Money, and Purchase Money Mortgage.